CEIBS survey reveals impact of COVID-19 on business in China

By Xu Bin

A CEIBS research team, comprised of Professors Juan Fernandez, Dongsheng Zhou and myself as well as two research assistants, has conducted the annual online CEIBS China Business Survey every year since 2010. Most of the participants in our survey are corporate executives who are CEIBS alumni. Our team also conducted an online survey this past April to explore the impact of the COVID-19 pandemic on business operations in China.

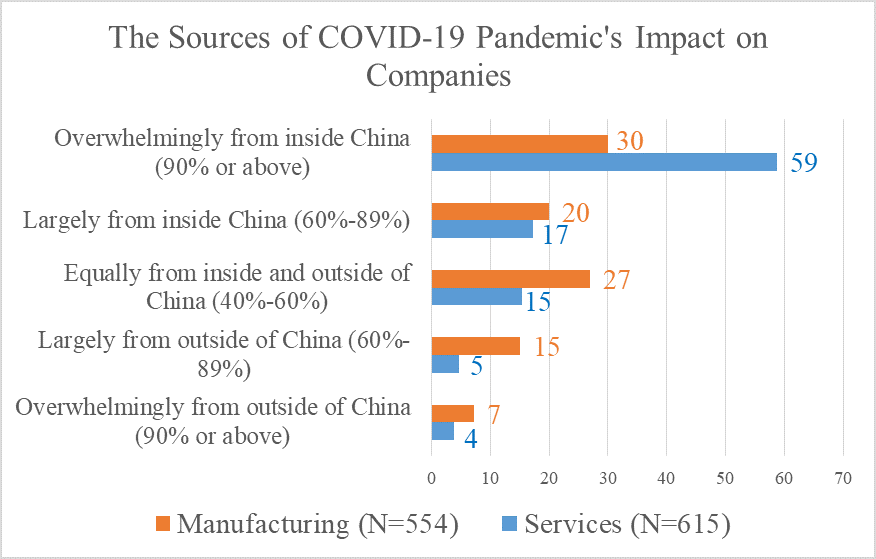

In response to the question, “How is the COVID-19 pandemic impacting your company?”, 59% of respondents in the service industry stated they expected that at least 90% of the effect on their business would be due to events in China, while less than 10% believed the impact would be “mainly from overseas”.

In contrast, when it comes to manufacturing, the results were evenly distributed, with 30% of respondents reporting that 90% or more of the effects of the pandemic on their companies emanated from China, with 27% reporting that domestic and overseas impacts were roughly equal.

In general, the impact of the pandemic in the first quarter mainly came from China, but the overseas impact cannot be ignored, especially for manufacturers, as shown in figure 1 below.

Figure 1

The question, “By the end of June, what percentage of your company’s business activities do you expect to return to normal?” saw different responses from service and manufacturing sectors.

In the service sector, the food, accommodation & travel and education segments were pessimistic with regards to recovery in the second quarter – with 41% and 32% of companies in each segment, respectively, expecting that less than 40% of their business activities would return to normality by the end of June.

Financial services and telecommunications & information services are expected to recover more quickly, with 56% and 54% of companies in each sector, respectively, anticipating 80% or more of their business activities to return to normal by the end of June. In contrast, the manufacturing sector expects a strong recovery by the end of June, with 48% of companies expecting 80% or more of their business activities to resume by the end of June.

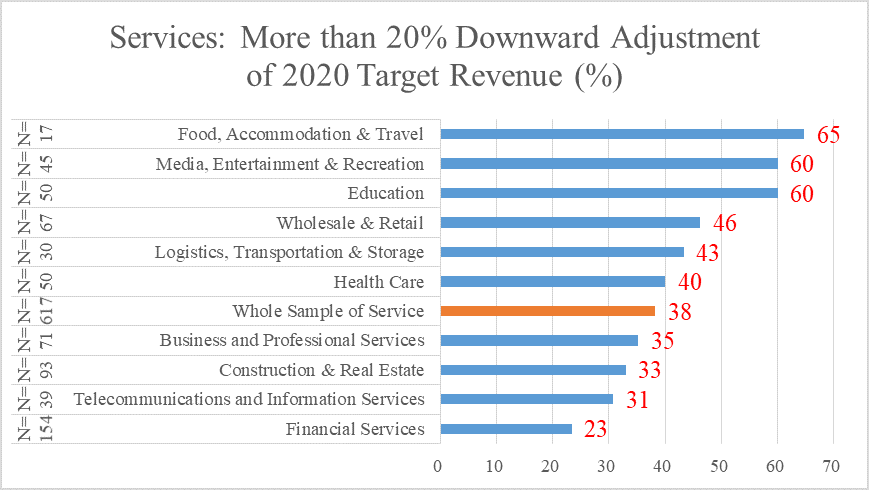

Our survey also found that, in the food, accommodation & travel; education & media; and entertainment and recreation segments, more than 60% of firms have adjusted their year-end revenue targets down by 20% or more. The main reason cited was that these segments were heavily hit in the first quarter and expect a slow recovery in the second quarter. There were fewer adjustments, however, in financial services, telecommunications & information services, as well as construction and real estate.

In general, service providers expect that the pandemic shock on business performance would continue in the second half of the year, as shown in figure 2.

Figure 2

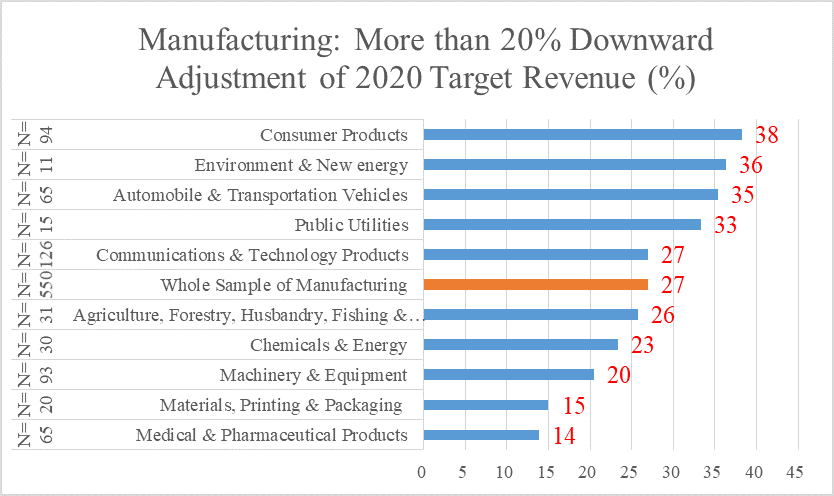

On the whole, 38% of companies in the service industry have slashed their 2020 revenue targets, compared with only 27% in manufacturing. The biggest reductions in full-year revenue targets in manufacturing were in the consumer products, environment & new energy, and automobile & transportation vehicle segments, with 38%, 36%, and 35% of companies in each segment, respectively, cutting revenue targets by more than 20%, as shown in figure 3.

Figure 3

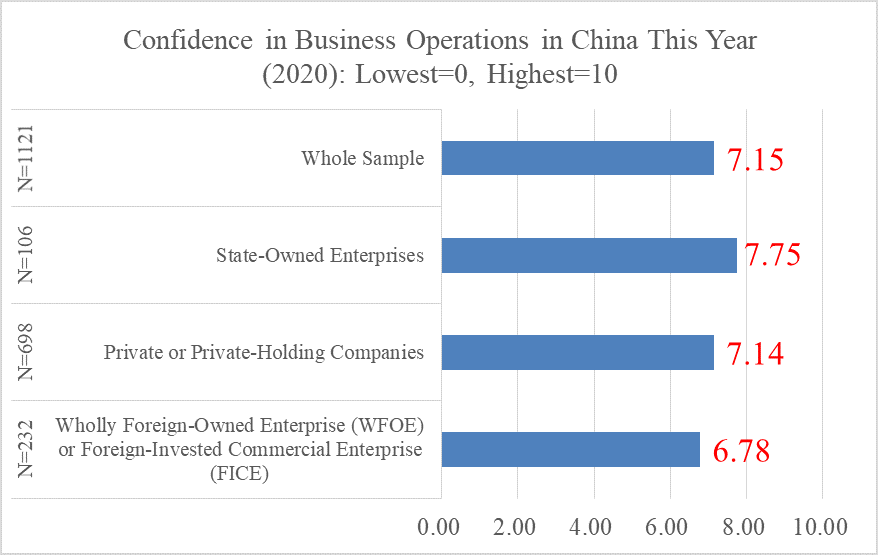

The following chart shows businesses’ confidence level in China for this year, with an average score of 7.15 (10 being the most confident). State-owned enterprises, private companies and foreign-owned companies reported levels of 7.75, 7.14 and 6.78, respectively.

Figure 4

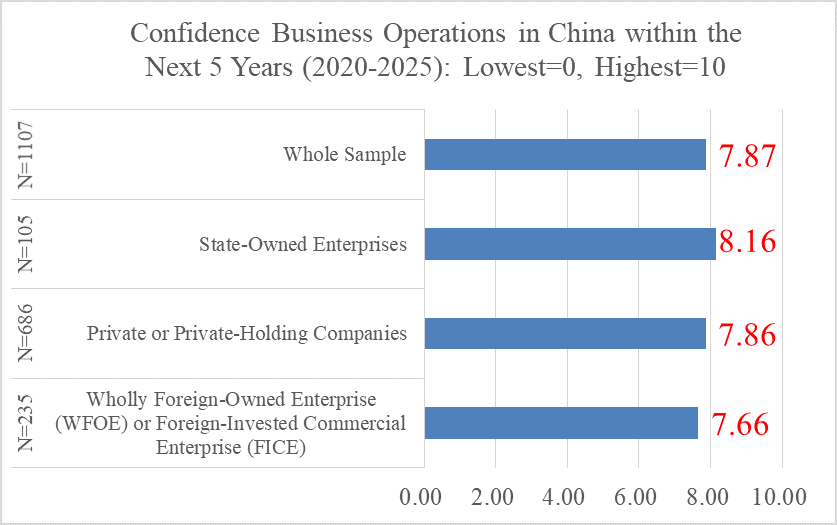

The following chart further shows the confidence index of businesses operating in China over the next five years (2020-2025). The overall average score is 7.87. In particular, state-owned enterprises, private businesses and foreign-owned companies reported levels of 8.16, 7.86 and 7.66, respectively.

Figure 5

The above charts show that companies in the sample are more confident over the long term, on average, than the short term. State-owned companies are most confident about their business operations in China, followed by private companies. Meanwhile, foreign companies are least confident with their score significantly lower than the average over both the short and long terms. These results indicate that the Chinese government needs to optimise the investment and business environment for foreign companies and improve industrial policies to boost confidence amongst foreign enterprises in China.

Xu Bin is Associate Dean (Research) and a Professor of Economics and Finance at CEIBS. Juan Fernandez is Associate Dean, Director of MBA Programme and a Professor of Management at CEIBS. Dongsheng Zhou is the Department Chair (Marketing) and a Professor of Marketing at CEIBS. Danni Chen is a research assistant at CEIBS and also contributed to this study.